Introduction

Introduction

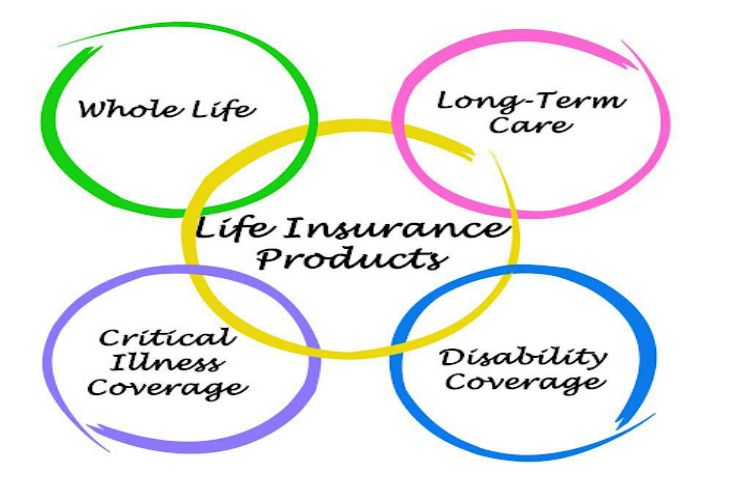

The acquisition of critical illness insurance has become a significant factor in the protection of individuals against the financial costs and emotional stress associated with major health events. Critical illness insurance is designed to provide financial relief to individuals diagnosed with critical health conditions such as cancer, heart attack, stroke, or kidney failure. The coverage also caters to the expensive treatments and rehabilitation services that regular health insurance plans do not cover.

Critical illness insurance offers different types of policies, including those that cover specific diseases and those that provide regular payments over an extended period. It is advisable to choose a policy that best fits an individual’s unique situation and needs. For example, the “specified disease” insurance policy covers one or two specific illnesses such as cancer or heart disease, and pays out a lump sum benefit upon diagnosis, as well as additional benefits throughout the course of treatment, including rehabilitation expenses and lost wages. On the other hand, the “comprehensive” insurance policy provides coverage for a wide range of illnesses from cancer to stroke and more serious conditions like organ failure or multiple sclerosis (MS).

The benefits of critical illness insurance cannot be overemphasized. First, it provides financial security by offering a lump sum benefit when an individual becomes critically ill or suffers from an eligible condition. This money can cover medical costs related to diagnosis and treatment, rent, mortgage payments, and everyday living expenses during the recovery period. Secondly, it offers peace of mind by taking away the stress associated with dealing with a serious medical event. This allows individuals to focus on getting better instead of worrying about how to pay for care or make ends meet while recovering without income due to disability leave or reduced hours at work due to health issues. Lastly, it provides flexibility in coverage options as individuals have several options when it comes to choosing a policy.

When considering the acquisition of critical illness insurance, it is essential to consider cost and coverage considerations. Health insurance can be expensive, and it is vital to factor in monthly premiums and out-of-pocket costs when selecting a plan. Deductibles are often the most significant expense associated with health plans, and coinsurance is another common cost consideration. Coverage considerations are also essential as not all health plans offer the same services or medication coverage. It is important to choose a policy that caters to an individual’s specific health needs.

Generally, anyone over the age of 18 can be eligible for critical illness insurance. However, most policies require applicants to undergo a medical review before they are approved. This helps insurers determine if an applicant has any pre-existing conditions that could make them ineligible or increase their premiums. The cost and coverage of a critical illness policy depend on the insurer and the applicant’s health profile. Younger people tend to have lower premiums since they are less likely to become seriously ill in the near future. On the other hand, older individuals may pay more due to their increased risk of developing serious illnesses like cancer or heart disease in later life.

Generally, anyone over the age of 18 can be eligible for critical illness insurance. However, most policies require applicants to undergo a medical review before they are approved. This helps insurers determine if an applicant has any pre-existing conditions that could make them ineligible or increase their premiums. The cost and coverage of a critical illness policy depend on the insurer and the applicant’s health profile. Younger people tend to have lower premiums since they are less likely to become seriously ill in the near future. On the other hand, older individuals may pay more due to their increased risk of developing serious illnesses like cancer or heart disease in later life.

Conclusion

Finding the right plan for critical illness insurance can be a daunting task. It is essential to understand the different types of policies available, the benefits of each policy, and the cost and coverage considerations associated with each policy. By doing so, individuals can make informed decisions and acquire a policy that best fits their unique situation and needs.