If you’re trying to save money, invest, plan for retirement, or just get a better handle on your personal finances you need to know where your money is going.

Knowing what your income and expenses are is really the only way to have a clear picture of your financial situation. Tracking your finances can help you know how much you’re spending, what you may be wasting money on, and how you can improve.

Tracking the money you have coming in and out is also a great budgeting tool. You may think twice about that double shot latte knowing you have to put it into your tracking system.

If you’re hoping to achieve some major financial milestones, here’s a guide to kick start that process with everything you need to know about financial tracking.

How to Keep Track of Money

Keeping track of your money is a crucial part of financial success. If you don’t have an idea of what your expenses are and how much you’re bringing in, it can be almost impossible to reach a financial goal.

In terms of how to keep track of your money, there are a few simple ways to do this. The easiest way to track your finances is by using a personal finance app https://setapp.com/lifestyle/the-best-personal-finance-apps-for-mac. These are available right on your phone for easy access. Many apps also synch with your bank account and credit cards so they do a lot of the work for you.

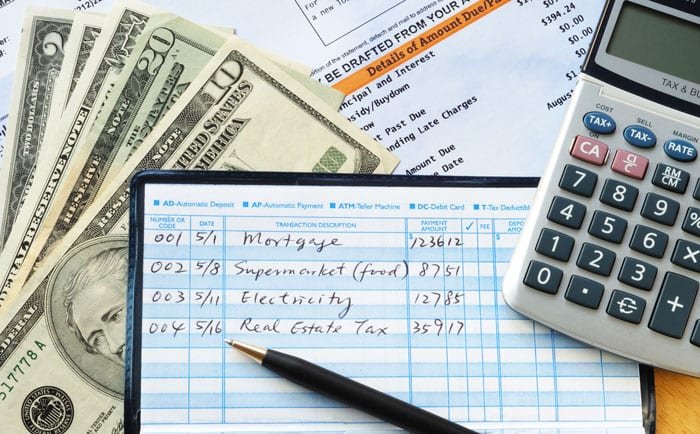

You can also take a more old-school approach and use a pen and paper to track your spending. An excel sheet can also work well. However, you choose to do this keeping track of your finances can be really eye-opening.

Why Your Income Matters

When you are starting to track your spending, your income plays a big role in this. The best reason to record income at the top of a budget is so that the number is right there in your face.

It is actually pretty simple when you think about it. If you have more money going out than in, there is a problem.

If you are overspending in comparison to your income, this can help you see where you need to cut back and by how much.

Know Where Your Money is Going

The most important aspect of tracking your finances is to know where your money is going. Tracking your spending may seem like a daunting task, but even just doing it for a month can give you a nice snapshot of your spending habits.

To properly track your expenses, you should start by writing down or inputting all of your fixed costs. Your fixed costs will be things like your electric bill, your rent, your car payment, and your student loan payments.

You should then start tracking your weekly spending on things like groceries, eating out, shopping, and services,

Don’t forget to include things like dog walking, hair coloring, and coffee. Literally anything you spend your money on should be included.

Control Expenses and Curb Spending

Once you see where your money is going, you can start to enact change. Let’s say after you lay out all of your expenses and income, there is money left over each month that has been going into your checking account.

Some of the extra money you may have can be automatically transferred to a savings account or it can be put into a retirement fund. Whatever your financial goals are, seeing what money you have remaining will help you plan.

If you’re seeing you are spending way more than you’d like to, don’t panic. Start making some real changes to do better.

Look at your expenses and start making some cuts. Chances are you are probably spending money on a streaming service of some kind you don’t even remember you have.

Maybe you have a group fitness pass to a neighborhood you don’t even live in anymore. These are things you can cut. Just an hour one day and you can probably trim a lot of fat.

Make a Budget

Making a budget is the next critical part of tracking your expenses. Make realistic budgets for things like entertainment and groceries so that you don’t set yourself up for failure.

One of the easiest ways to save some money is to cut things like going out for coffee, driving everywhere, taking ride-sharing services, and drinking expensive drinks. Shift to a mindset where you entertain people at home or maybe you eat at places where you bring your own alcohol.

Convenience services are another big expenditure. Cut your own grass, walk your dog, pick-up food instead of having it delivered, and do your own laundry. When money is tight, don’t spend it like you have all the money in the world.

Reduce Your Debt

Another great aspect of tracking your spending is that you will get a better picture of how much debt you have. You’ll see your credit card statements and activity more regularly and you can make a plan to pay this down if you need to.

If you plan on making any big purchases or obtaining financing for things like a home or car loan, your debt to income ratio matters. The amount of debt you have will affect your interest rate, your loan terms, and how much you qualify for.

Before you do anything, make paying off your credit card debt a priority. Check your credit score as well to see if there is any debt you are unaware of.

You Need to Know Your Income and Expenses

When it comes to tracking your income and expenses, this is a powerful habit to get into. You’ll be able to see where all of your money is going and make a plan to reach your financial milestones.

If you have specific goals in mind, start by setting small goals that can help you reach your bigger ones. Small goals will help you get to your desired endpoint faster. They will help keep you on track and keep you motivated to reach your bigger ones.

Using an app, your phone, a notepad, or whatever method you choose, once you get in a groove of tracking your money, it will seem like no big deal at all. Remember that this is well worth the effort.

If you’re looking for more personal finance tips, check out the services and business section for some great resources.