Many earners use a tax refund calculator to calculate their potential refund or bill without knowing whether they’ll be owed money or owe money. It can be nerve-wracking, especially when you haven’t kept track of your income or earnings to understand the likely tax implications.

Many earners use a tax refund calculator to calculate their potential refund or bill without knowing whether they’ll be owed money or owe money. It can be nerve-wracking, especially when you haven’t kept track of your income or earnings to understand the likely tax implications.

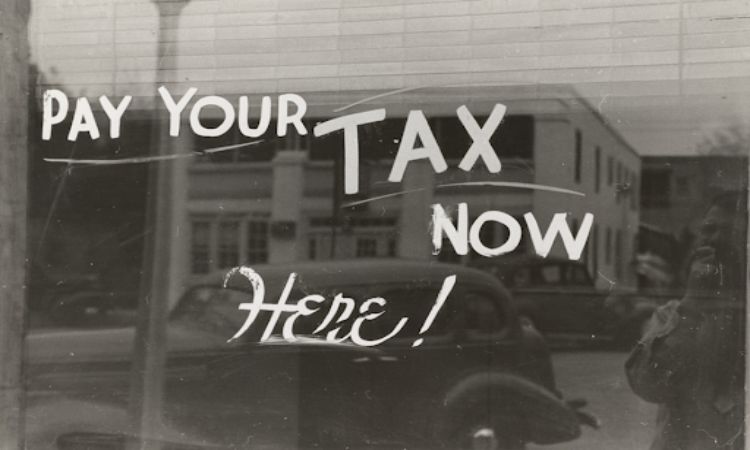

This is why being well-informed about taxes can be so important. The more you know, the easier it can be to determine your tax obligations. A great first step is to learn about the following income types that generally aren’t taxed. By the end of the article, you should have greater insight into your end-of-year situation so you can make informed financial decisions.

Health Savings Account Distributions

Healthcare can be expensive, and having to pay taxes on any money you have set aside for healthcare could add to your stress. Fortunately, you don’t have to pay tax on your health savings account distributions as long as you use them for qualifying medical expenses.

If you’re disabled or aged 65 or older, you also won’t pay taxes on your health savings even if your medical expenses aren’t qualified.

Earned Income

While you’re required to pay income tax in most states in the United States, it’s not a requirement in all states. In fact, if you earn income in Texas, South Dakota, Tennessee, Alaska, Nevada, Florida, Wyoming, or Washington, you won’t be required to pay income taxes.

However, it’s worth being aware that not paying income taxes might mean you pay more in other taxes to make up the difference. Property, excise, and sales taxes might be more expensive in these states. Investment in healthcare, education, and infrastructure may also be limited compared to other states.

Disability Insurance Payments

While disability benefits through your employer are taxable, several disability insurance payments aren’t. For example, if you’re receiving workers’ compensation payments, disability benefits from a public welfare fund or no-fault car insurance policy, or supplemental disability insurance from your after-tax dollars, you likely won’t need to pay taxes on them. Private disability insurance plan payments and compensatory damages are also non-taxable.

Having a disability is challenging enough, so it can be a weight off your mind knowing that federal and state governments are not chasing you for the money you might need for everyday living.

Financial Gifts

It can sometimes seem like federal and state governments want to take a percentage of everything you earn. However, financial gifts are received, not earned, which means they are yours to keep. As long as you’ve received something of monetary value without giving something of equal value in return, you won’t have to pay income tax on it.

The IRS considers cash, securities, real estate, vehicles, and art to be gifts, but educational expenses, medical expenses, spousal gifts, and donations or gifts to political organizations are excluded. There are also annual limits to be aware of. In 2023, you can only give someone up to $17,000 per year with a lifetime limit of $12.92 million without paying tax.

Life Insurance Benefits

If someone dies and leaves you a life insurance benefit, you can use this money as you please without any tax obligations. Life insurance payments are also not included with your gross income, and you don’t have to report them. However, there are exceptions. If you receive interest on your life insurance payment, this must be recorded as interest received.

Taxes are one of the few things in life that are not going anywhere. However, you might be surprised by how many forms of income aren’t taxed, allowing you to keep more of your hard-earned money than you expected.